11 Jefferies Group Broadcom Trades

Jefferies Group's position in Broadcom is currently worth $55.8M. That's 0.95% of their equity portfolio (17th largest holding). The first Broadcom trade was made in Q4 2022. Since then Jefferies Group bought shares five more times and sold shares on five occasions. The stake costed the investor $29.8M, netting the investor a gain of 87% so far.

News about Broadcom Inc and Jefferies Group

5G Net Security Market Is Booming Worldwide : F5 Networks, Verizon Communications, Palo Alto, Broadcom

New Jersey, USA -- ( SBWIRE ) -- 09/13/2022 -- Advance Market Analytics published a new research publication on "5G Net Security Market Insights, to 2027" wi...

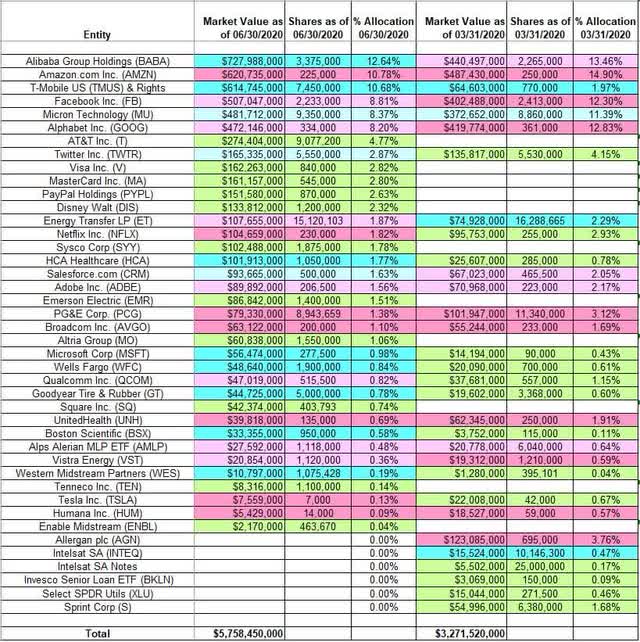

Tracking David Tepper's Appaloosa Management Portfolio - Q2 2020 Update

David Tepper¡¯s 13F portfolio value increased from $3.27B to $5.76B this quarter. Appaloosa added AT&T while increasing Alibaba Group Holdings during the quar...